-

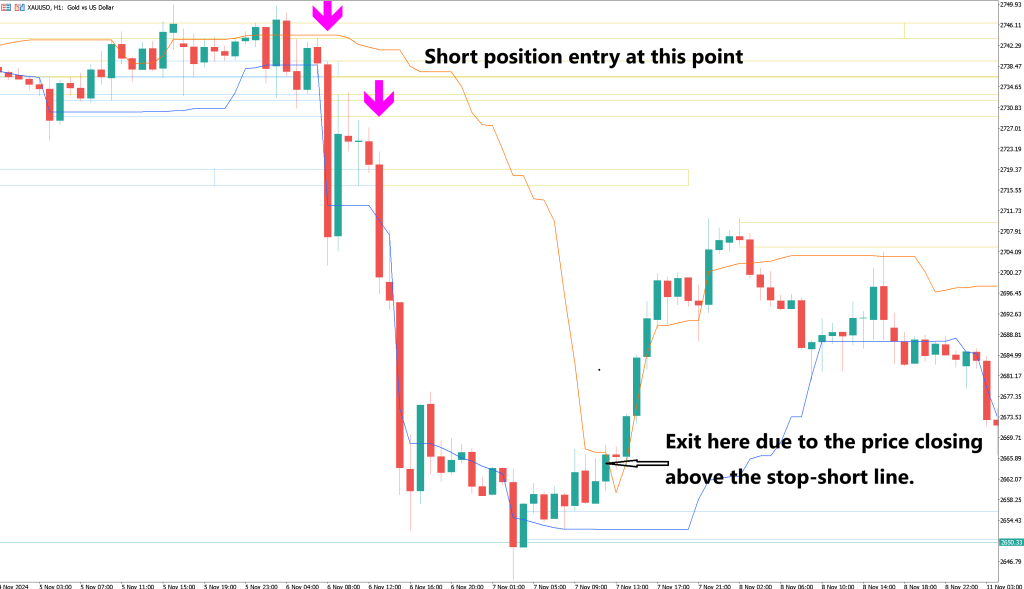

Indicators MT4 How to take profit MT4

$39.00

$79.00 -

Exclusive Membership Platinium VIP

- 5 Live Account License

- Unlimited Demo Licenses

- Free Updates for Life

- Easy Installation Videos

- High Performance Settings

- Lifetime Membership

$1,399.00 – $1,800.00

-

Mobile Background An elegant East Asian woman dressed in traditional hanfu-style

- Immediatly Available

- 3840 x 2160 / 2560*1600 / 1920 x 1080 / 1024*780 / 1280 x 720

- Full HD, Lifetime Licence

$0.89

$1.99 -

Mobile Background A minimal and elegant image of cherry blossoms

- Immediatly Available

- 3840 x 2160 / 2560*1600 / 1920 x 1080 / 1024*780 / 1280 x 720

- Full HD, Lifetime Licence

$0.99

$1.79

Chande Kroll take profit indicator MT5

Category: Indicators MT5.

$39.00$99.00

Learn about the Chande Kroll indicator, a trend-following indicator that uses average true range (ATR) to set stop-loss levels and highlight trend reversals. Ideal for traders seeking to align with market trends, this tool provides clear buy and sell signals and helps manage market volatility effectively.

Login with Google

Login with Google Login with Facebook

Login with Facebook